Good money habits are hard to form. We live in a world that encourages us to feel entitled to the money we don’t have. Do you want a new car? Get a loan and make payments! Do you want to go to college? Take out student loans! Do you need some retail therapy after a hard week? Grab your credit card on the way out and enjoy!

Many of us are teaching our kids terrible money habits and leaving them in a difficult position. The school system doesn’t teach our kids about money management, and often kids don’t look to financial experts until they are already in a bad place. So, it is up to us!

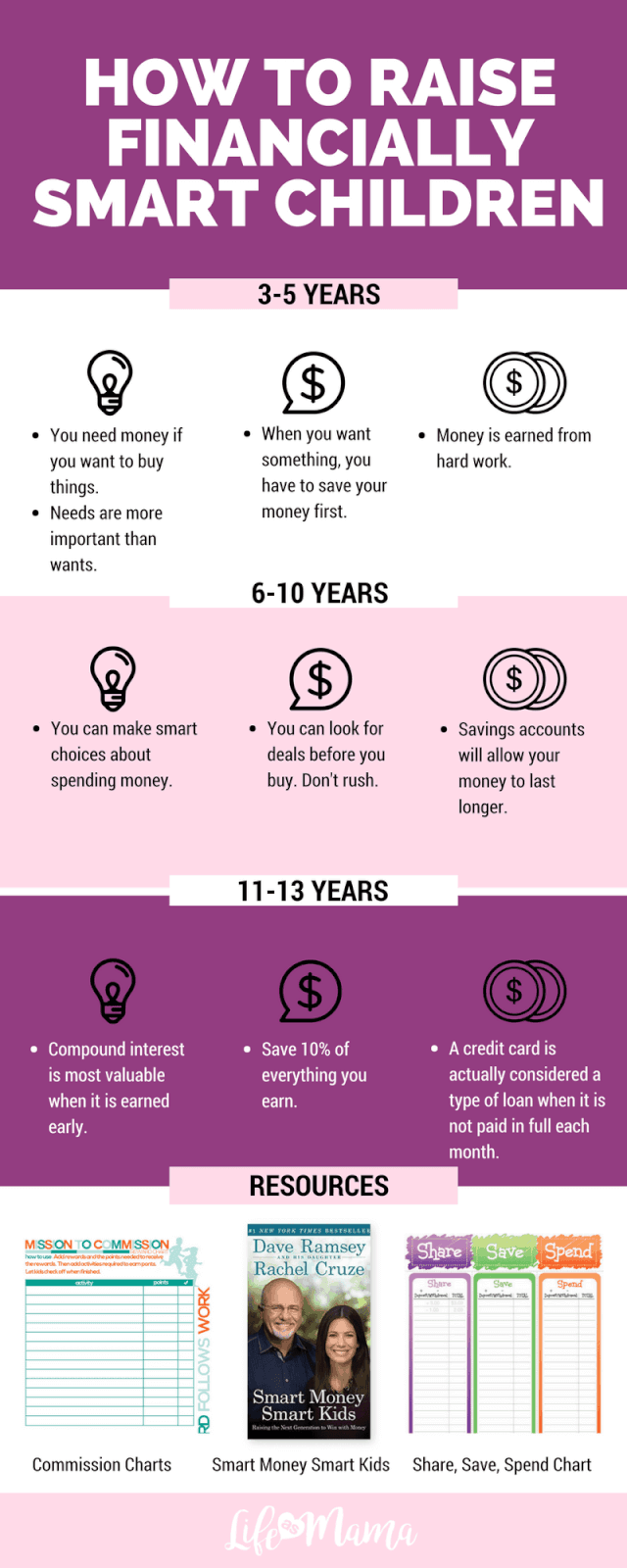

Financial expert and best-selling author Dave Ramsey and his daughter Rachel Cruze have written a book to help us raise financially smart children: Smart Money Smart Kids: Raising The Next Generation To Win With Money (affiliate link). This book includes great guidelines and examples of how we can get our own money in order and teach our kids through example! After all, children learn more through your actions than from anything you say.

The first step for children to develop a healthy relationship with money is to understand that money is a direct result of hard work.

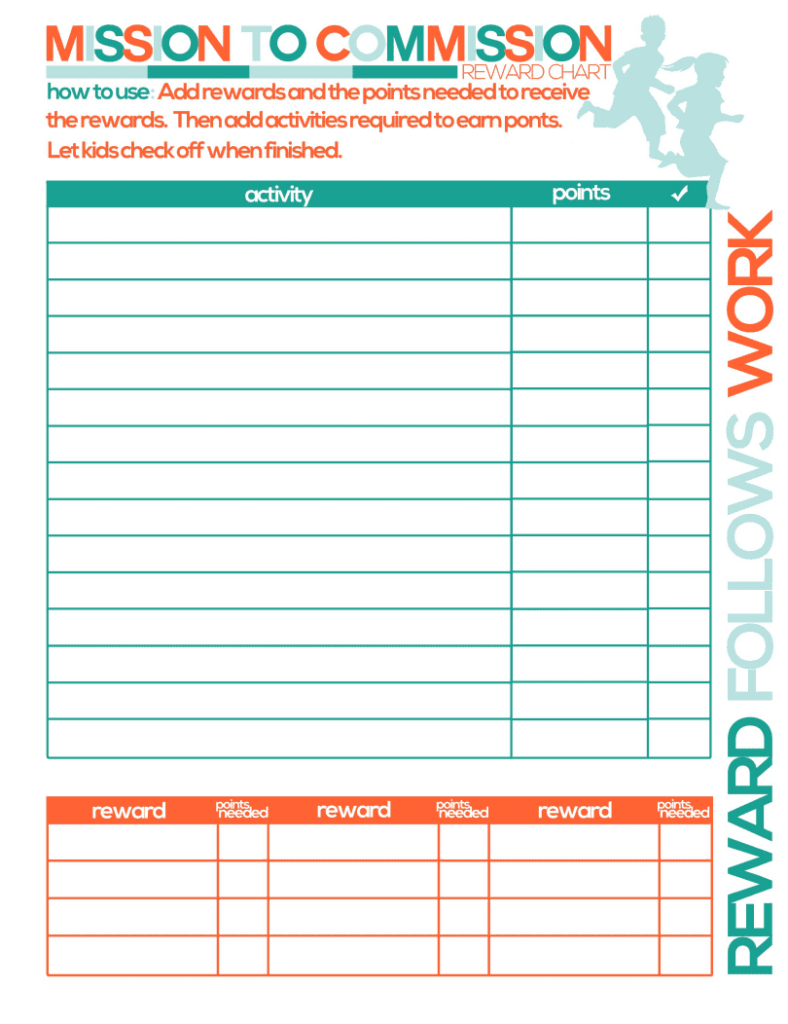

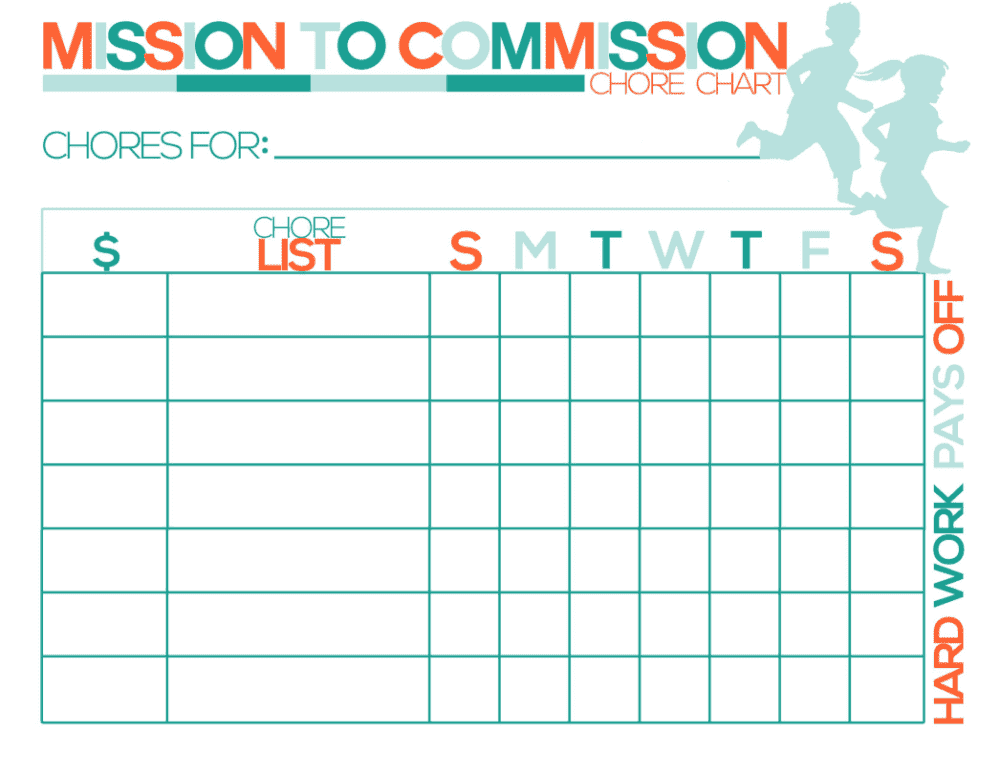

The idea of hard work is what instills drive and dignity into their young characters. This means that parents should do more than just hand out allowance. Allowance sounds a lot like “government assistance” when it is given without the expectation of completing chores. Instead, develop a commission base allowance. This will combat entitlement by encouraging a good work ethic. No, this does not mean children should be paid for everything they do around the house. Some chores are expected because they are a part of the family and must contribute. These chores are not rewarded. You can decide what chores are expected and which ones are considered “extras.”

What we began in our family with our five-year-old daughter and two-year-old son is a commission’s chart. (You can get a free copy below!) We have given them three chores each: clean bedroom, clean house, and feed pets. When they complete their chores, they get a dollar for their jar! Chores that they do not get paid for is cleaning up their plates after dinner, putting away their laundry, and cleaning up extra messes that they cause (like spilled drinks, cheerios, etc.). There is no “right” or “wrong” chore to be added on the commission’s chart — you decide.

Free Commissions Chart

Source: simplisticallyliving.com

Print Here

Below are pictures of my daughter’s money jar! She is saving up for a new princess water bottle and is SO proud to be able to buy it herself! She has learned that mommy and daddy bought her a water bottle she needs, but if she WANTS a princess one, she can save up for her wants.

It’s important for children to also learn the importance of saving and sharing their money! Right now we are in the phase of teaching our children the value of hard work, but soon they will have three jars for sharing, saving, and spending! We hope this will encourage a long-lasting habit for financial peace that impacts generation after generation.

Print a FREE Share, Save, Spend chart to teach your children the value of giving and saving.

Here is an infographic that includes what you should be teaching your children about money at each age. Take a look!

Another option is to get a debit card

As a parent who is determined to ensure their kid becomes financially literate as soon as possible, you may want to consider getting a debit card. You can either have one for a joint bank account or a prepaid card for your kid. A kid’s debit card can teach your child how to budget. Your child will be in control of their money and how they spend it.

Debit cards will also teach your child how to be accountable in life. They will be financially responsible for each dime, and if they deplete their funds, there will be no one to blame but themselves.

If you also want to teach your kids the actual value of money, you should consider a debit card. Lastly, a debit card can keep your child from losing money. Children tend to be forgetful and careless; if they have cash, they are more likely to lose it and not remember where they kept it. But with a debit card, it will be more difficult for your kid to lose money.

‘Tell us what YOU are doing to help raise financially smart children?